Background

Kaddex is a DEX (Decentralized Exchange) built on the Kadena blockchain. In June 2021 Kaddex held their private sale and raised 3,242,085 KDA. The private sale itself was dubious in nature because there was no KYC or any AML compliance, read more about that here (article by another author). If they liquidated the full raised amount at the price at the end of the sale, $0.45, they would sit on $1.5M, however they almost kept everything in KDA. Since then the price has done over a 10x.

Recently Kaddex held their public sale, KDA was $6.25 and they were already sitting on $20M USD. Do keep in mind that the Pact (backend blockchain) part, Kadenaswap, was already coded and provided by Kadena. You could ask yourself why Kaddex would even need a public sale, there was enough KDA left to provide liquidity and more to liquidate to finish programming.

On-chain investigations show some worrisome patterns. I was given this lead by an anonymous KDA and KDX holder, who I will not disclose unless they contact me saying they want to be mentioned. I followed up and found some weird transactions. About two weeks ago I reached out to Kaddex but I have not gotten a response, more about that later.

Yours truly is just a simple retail investor with a bag of KDA. Before we dive into it, I want to stress that I’m a big Kadena believer, it’s the only L1 that truly solved the trilemma and no other chain comes close. This is why I ask the community to objectively digest the information I present, help me ask questions and maintain high standards for all projects building on Kadena. I want to work together with everyone involved in Kadena to make this ecosystem perfect.

The Public Sale(s)

There were two public Kaddex sales, the first one is in February 2022, where KDX was sold for ETH, ERC-20, DOT and possibly more tokens. The second sale was in March 2022 where KDA could be used to buy KDX. In the first sale there would be 50M KDX for sale, valued at $0.16 a piece. Let’s discuss the sale events and related events in chronological order.

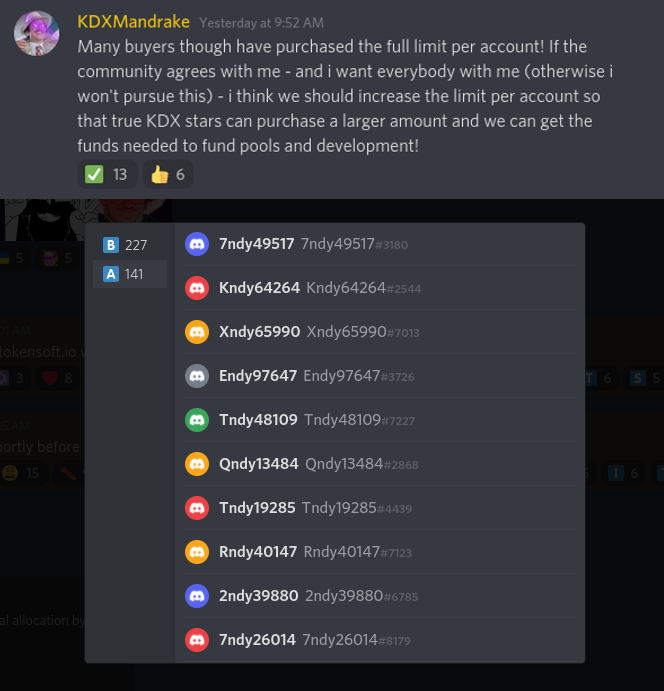

Originally Kaddex wanted to allow single buyers to buy up to 5M KDX, which is 0.5% of the total KDX supply. After the community complained (rightfully so!), Kaddex was forced to lower the maximum allocation to 100k KDX per buyer, Kaddex explainer article here. After just one single day into the sale, on February 2nd, Mandrake, the digital profile of the Head of Finance of Kaddex, currently Daniele de Vecchis, polled the Kaddex Discord in an attempt to raise the limit per account. The vote was found to be manipulated by bot votes voting for ‘A’, which was to increase the limit per buyer. Luckily the community won again by voting en masse for ‘B’, which was not to increase the limit per buyer.

Why did Kaddex and Mandrake push for this limit to be raised again, why is it so important for them? Head to Etherscan and check out this account: 0x94c94d97ced6fa71181979b0b083d99d4e2c0051. This single account bought 3,200,000 KDX or 0.32% of the total KDX supply through various proxy accounts. Feel free to click through the transactions, all the funds will end up on https://etherscan.io/tokentxns?a=0x1aeaab4451e565c70fd61e23298498203ff29b81 which is the Tokensoft KDX sale address.

Many questions arise. Who is this whale? Who is so extremely interested in KDX that they’re buying such large quantities? Note that their first purchase is on the 2nd of February, later that same day Mandrake wants to raise the limit, after they realize the community does not want the limit to be raised they break down their buys into wads of 100k KDX. Did this whale pressure Mandrake? The most likely answer to this is that Kaddex is likely buying their own KDX using the KDA they raised from investors in the private sale.

Why is it likely to be Kaddex?

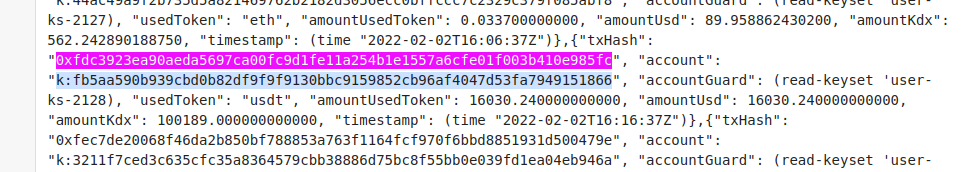

Let’s take the first 2nd of February transaction as example, the whale account sends 16k USD in USDT, which is exactly 100k KDX, to the first proxy account: https://etherscan.io/address/0x45cfb93c7fb1650c21a69efa1486778ca2f1e741#tokentxns right after that account makes the purchase with Tokensoft, here is the TX: https://etherscan.io/tx/0xfdc3923ea90aeda5697ca00fc9d1fe11a254b1e1557a6cfe01f003b410e985fc The TX is important because it shows who is going to receive KDX on the Kadena chain. Here is the relevant TX on the Kadena blockchain which allocates this address: https://explorer.chainweb.com/mainnet/txdetail/EebrQWGS4ph5SD1CNNuLPUVhdcWg3Ez2ZqXRe8hqitw

As shown, this TX is allocated to k:fb5aa590b939cbd0b82df9f9f9130bbc9159852cb96af4047d53fa7949151866 – remember this address. There is a second ETH address which is also connected, this address “only” buys 300k KDX: https://etherscan.io/address/0x00d05b8663a0d8b9c86e6c375e60b9c6c025a92d 300k added to the previous 3.2M amounts to 3.5M or 0.35% of the supply.

The Second Sale

In this sale KDX was sold for KDA. The Kadena blockchain is a bit harder to explore for transactions than the Ethereum one, so please bear with me. Kaddex collected the raised original KDA funds from the private sale into the account kdx-bank, you can view it yourself on the balance checker https://balance.chainweb.com/

The KDA public sale transfers can be found on Chainweb by searching for their code: kaddex.public-sale.reserve-on-chain https://explorer.chainweb.com/mainnet/txsearch?q=kaddex.public-sale.reserve-on-chain and you will be able to find all accounts who bought KDX with KDA.

I wrote a script which tracked on-chain transactions and counted the flow of KDA from kdx-bank (the private sale account) to the public reserve code. Please allow my script a margin of error, I encourage anyone capable and willing to verify the results manually or automatically and let me know if I made an error. The result it found was however significant, at least 113,951 KDA from the private sale chest ended up in the public sale chest through the use of about 100 proxy addresses, likely because the limit was set once again to a maximum of 100k KDX. At that time KDA was $6.25, for that amount of KDA an approximate 4,451,210 KDX was bought, or 0.45% of the total supply.

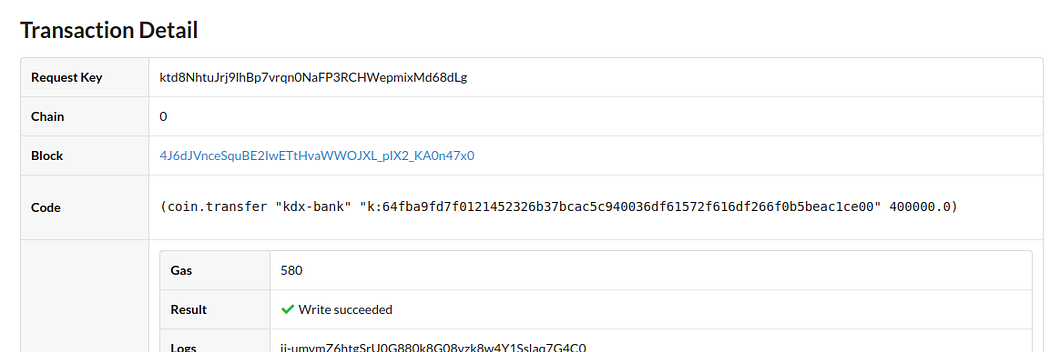

Let’s walk through this one with an example as well. We start at the beginning, the kdx-bank private sale vault: https://explorer.chainweb.com/mainnet/txsearch?q=kdx-bank — in a few large transactions kdx-bank sends funds to k:64fba9fd7f0121452326b37bcac5c940036df61572f616df266f0b5beac1ce00 — here’s an example of one of the transactions worth 400k KDA. This first address is the distribution account which further spreads out the KDA to proxy accounts to buy (often) max allocations of KDX.

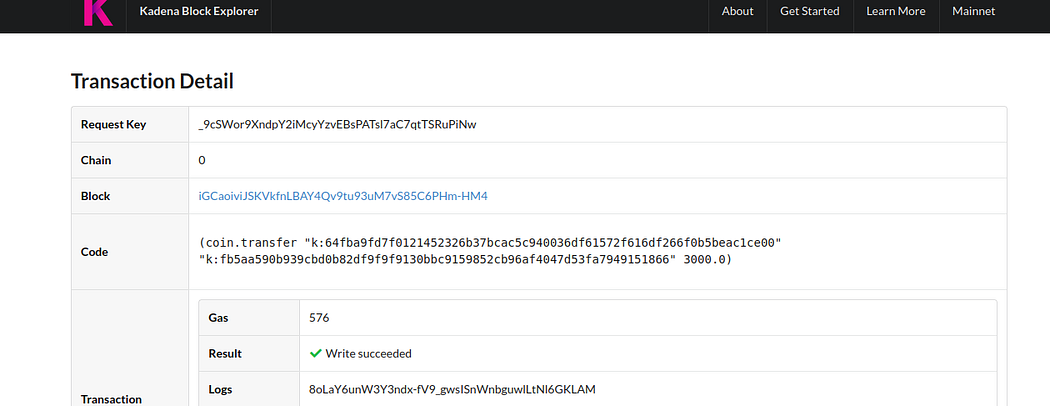

This k:64fba… account in turn sends out many transactions to different accounts, let’s take for example https://explorer.chainweb.com/mainnet/txdetail/_9cSWor9XndpY2iMcyYzvEBsPATsl7aC7qtTSRuPiNw — it sends 3000 KDA to k:fb5aa590b939cbd0b82df9f9f9130bbc9159852cb96af4047d53fa7949151866 – do you remember this account from the first public ETH sale? A very large amount of the addresses who receive 100k KDX from the ETH sale also receive funds from kdx-bank to buy another 100k KDX from the KDA sale.

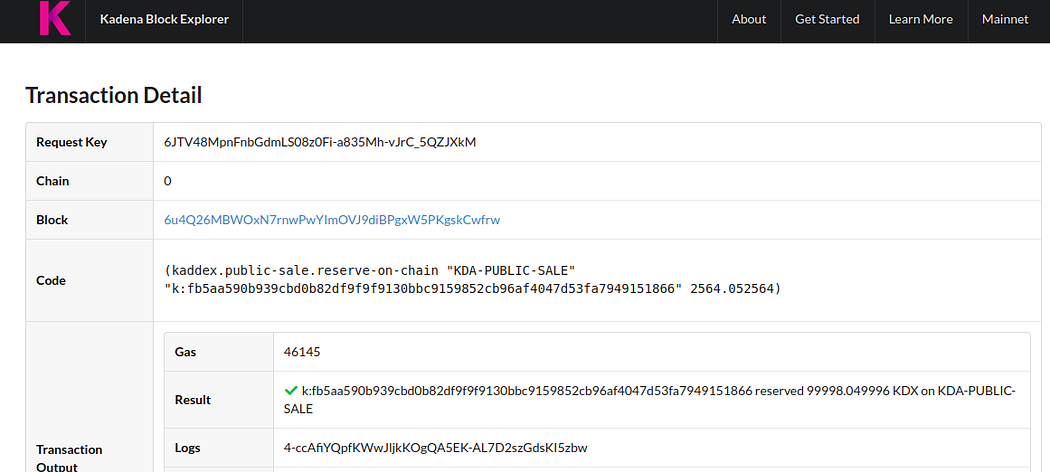

And here we can see that account ultimately buying KDX on chain: https://explorer.chainweb.com/mainnet/txdetail/6JTV48MpnFnbGdmLS08z0Fi-a835Mh-vJrC_5QZJXkM In just 3 transactions, KDA given to Kaddex in the private sale ends up buying KDX from the public sale.

I would like to stress that this is just one out of many strings of transactions that was easy to follow, as said there are about 100 proxy accounts involved which send KDA towards each other.

Response from Kaddex

Longer than two weeks ago, after I confirmed the findings of the person who tipped me off, I reached out to Emily Pillmore, whom I love and respect. Kaddex is hard to reach since they’re not on Telegram anymore and due historic events I wanted to ask someone who I know I could trust. Emily is not directly involved with Kaddex but she helps out as an advisor (edit: even the advisor role isn’t official yet). I trust her more than Kaddex and thought it was the most effective way to get a real answer regarding all these transactions. I will not disclose the exact full contents of the chat. Emily said she’d ask Kaddex and that was the end of it, I never got a response.

Conclusion

Adding the 0.45% and the 0.35% amounts to 0.8% of the total KDX supply being bought by a group of addresses which all got their funds from one single source: the Kaddex presale investor stash. There was also a possibility to buy with DOT and additional transactions on KDA and ETH may have been missing or hidden better from the calculations, so the number 0.8% could be slightly off. For reference how large 0.8% of the supply of a coin is; there are only two wallets holding more than 0.8% of the BTC supply and those are the Binance and Bitfinex cold wallets.

Did Kaddex allocate themselves a free 0.8% of the supply? Did Kaddex allow some kind of whale to buy 0.8%? Why was the community, who called for a 100k KDX max allocation, blatantly ignored? Why were Kaddex invested community funds used to buy their own KDX sale?

To quote Kaddex from one of their Medium articles: “We stand for full transparency”, I call upon Kaddex to explain what happened here and if needed amend the situation to do just to all investors who trusted Kaddex.

Furthermore I encourage the Kadena community and Kaddex investors to ask Kaddex for clarity regarding these buys. To quote Emily Pillmore from my DMs: “one[sic] less scammy blockchain project is better for us all[sic]”.

Lastly I call upon prominent (upcoming) Kaddex partners like Coinmetro and Hypercent, who I know are very ethical companies, to encourage Kaddex to explain what happened here and if needed amend the situation.

Update 19/04/2022: A community member you all know and love, Thanos, spent all night drawing a graph of the flow of KDA from kdx-bank (private sale) to Tokensoft (public sale) to verify findings in this article. https://anedak.com/kdx-bank-fund-recycling-fix.svg

Update 29/04/2022: A community member by the name of ‘A’ created an updated graph of all the KDA flowing from kdx-bank (private sale) to Tokensoft (public sale). It’s shown below. The actual number found by A, was found to be significantly higher than originally found by my script. The real number is 204K KDA. That means Kaddex bought about 7,968,750 KDX, or 0.8%, adding to the previous 0.35%, that’s 1.15% of the total KDX supply.